The Ultimate Guide to Handling a Car Accident in Georgia

Car accidents in Georgia can be overwhelming, leaving you uncertain about what to do next. From managing injuries and vehicle damage to navigating insurance claims and legal processes, the steps you take after an accident are critical to protecting your rights and securing fair compensation. This comprehensive guide, crafted from expert advice, walks you through every stage of handling a car accident in Georgia, ensuring you avoid common pitfalls and maximize your claim’s value.

1. Immediate Steps After a Car Accident

The moments following a car accident are crucial. Acting quickly and wisely can safeguard your health, protect your legal rights, and strengthen your claim. Here’s what to do:

- Ensure Safety: If possible, move your vehicle to a safe location, such as the shoulder of the road, and turn on your hazard lights to prevent further accidents. Check yourself and others for injuries.

- Seek Medical Attention: Even if you feel fine, get a medical evaluation as soon as possible. Some injuries, like whiplash or internal trauma, may not be immediately apparent but can worsen over time. Prompt medical documentation is also critical for your insurance claim.

- Contact the Police: Call 911 to report the accident, especially if there are injuries, significant damage, or disputes about fault. In Georgia, police will create an official accident report, which is a key piece of evidence for your claim.

- Exchange Information: Collect the following from all involved drivers: full name, phone number, address, driver’s license number, license plate number, and insurance details (company name, policy number). Also, gather contact information from witnesses.

- Document the Scene: Use your smartphone to take photos of the accident scene, including vehicle damage, skid marks, traffic signs, and any visible injuries. These images provide valuable evidence for determining fault and supporting your claim.

- Avoid Admitting Fault: Do not apologize or admit responsibility, as this could be used against you by insurance companies or in court. Stick to factual statements when speaking to others at the scene or to insurance adjusters.

By taking these steps, you lay a strong foundation for your claim and ensure critical evidence is preserved.

2. Understanding the Georgia Car Accident Report

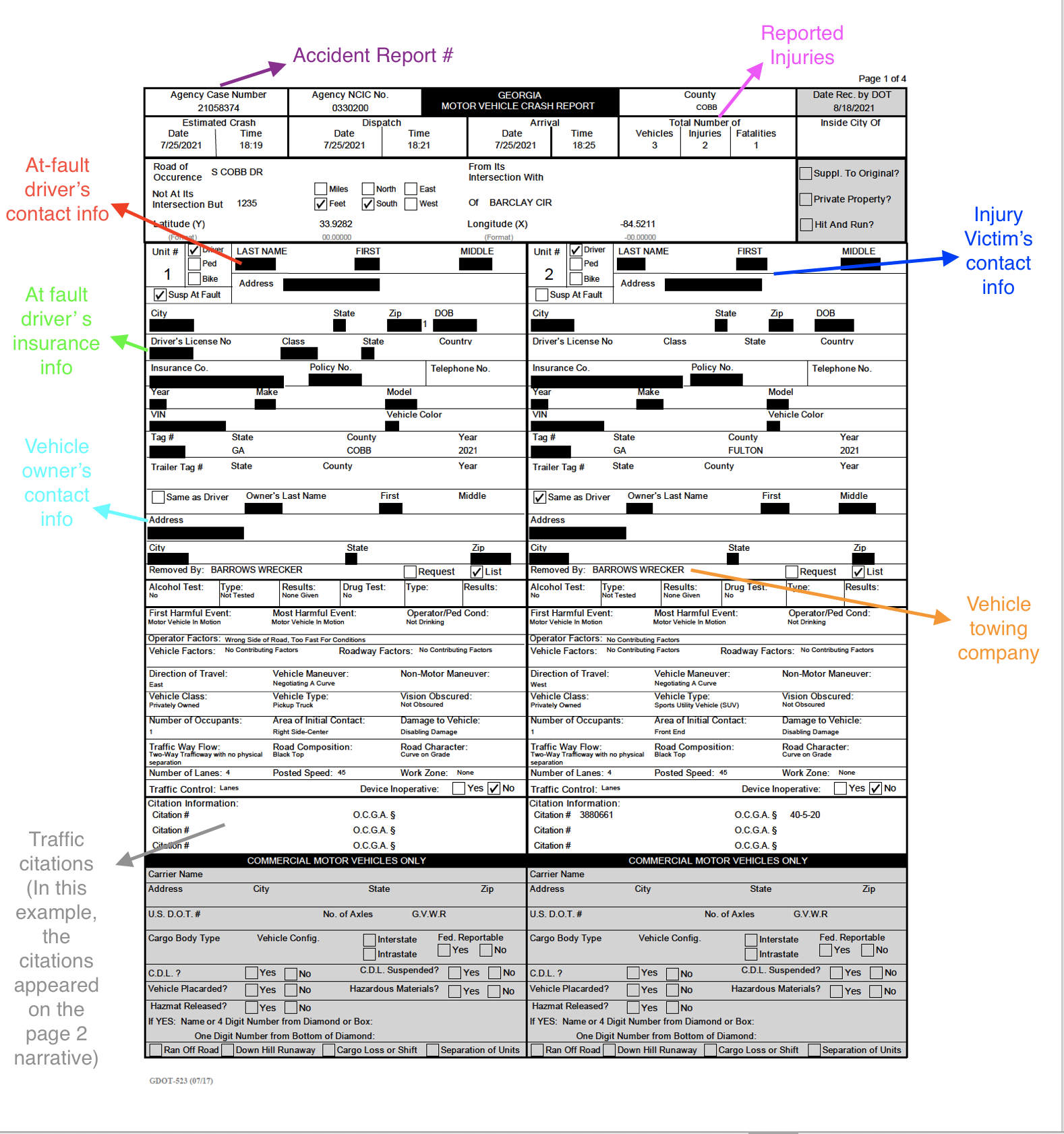

A Georgia car accident report, prepared by the responding police officer, is a vital document that details the crash and helps establish fault. Understanding its contents can significantly impact your claim.

What Is a Georgia Car Accident Report?

The report includes essential details such as the date, time, and location of the accident; names and contact information of involved parties; vehicle descriptions; a narrative of the crash; a diagram of the scene; witness statements; and any citations issued. It may also note contributing factors like speeding or distracted driving.

How to Obtain the Report

You can request a copy from the police department that responded to the accident or through online portals like BuyCrash.com. Typically, reports are available within a few days and may cost a small fee.

Key Sections to Review

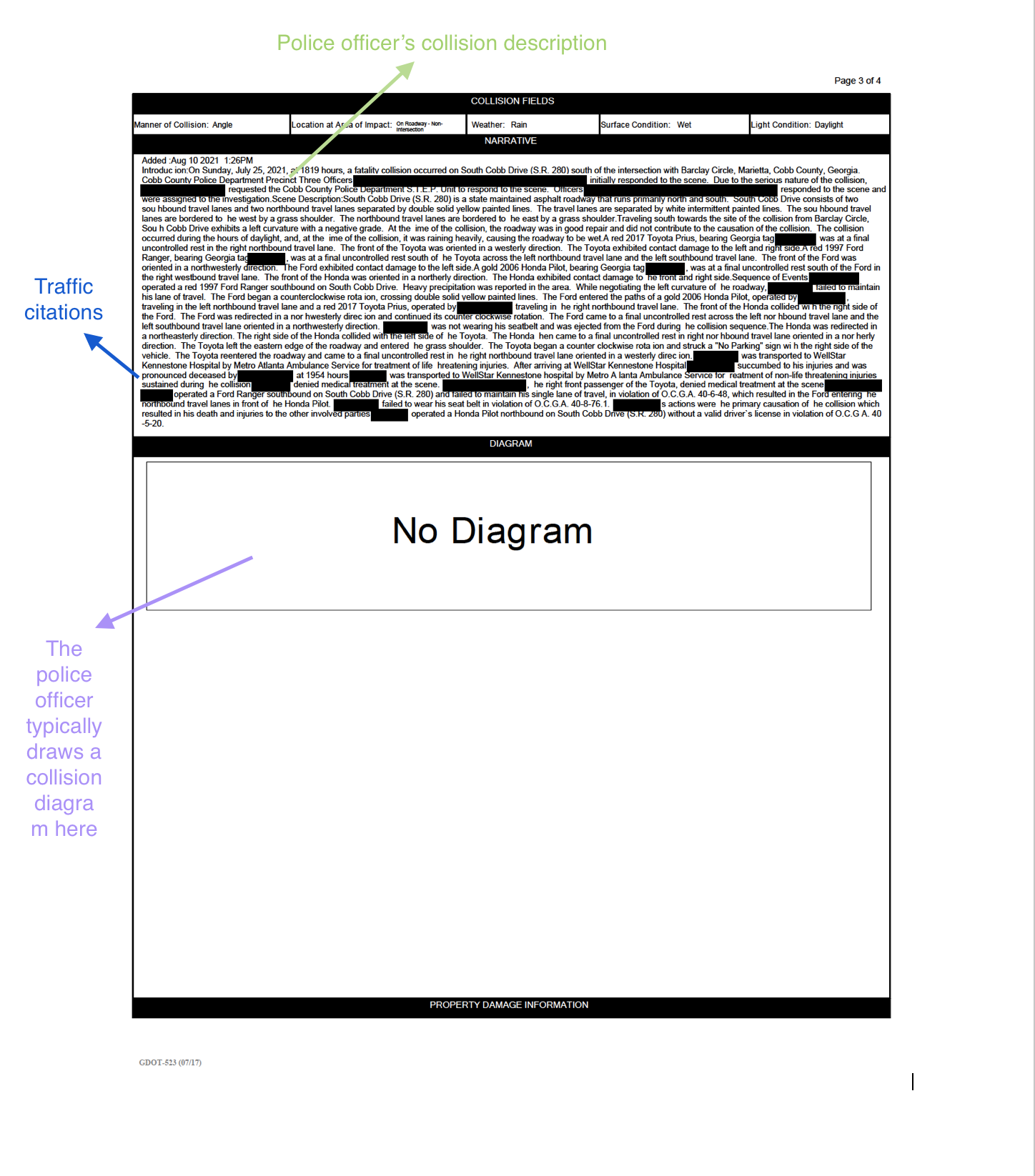

- Crash Narrative and Diagram: The officer’s description of how the accident occurred and a visual representation of the scene.

- Driver and Vehicle Information: Confirms the identities and insurance details of all parties.

- Witness Statements: Independent accounts that can corroborate your version of events.

- Contributing Factors: Notes on road conditions, weather, or driver behavior that may influence fault determination.

Using the Report in Your Claim

The report helps insurers and courts determine liability. For example, if the other driver was cited for running a red light, this strengthens your case. Share the report with your insurance company and Atlanta car crash attorney to support your claim.

Checking for Errors

Review the report carefully for inaccuracies, such as incorrect driver details or a misleading crash narrative. If you find errors, contact the police department promptly to request corrections, as these mistakes could weaken your claim.

Understanding and leveraging the accident report ensures you have accurate documentation to back your case.

Georgia Car Accident Report

Police officer collision Description

3. Handling a Totaled Vehicle

If your car is deemed a total loss after the accident, navigating the insurance process becomes more complex. Here’s how to handle it in Georgia:

What Does ‘Totaled’ Mean?

In Georgia, a vehicle is considered totaled when the cost of repairs exceeds 75% of its actual cash value (ACV), as determined by sources like Kelley Blue Book or NADA. For example, if your car is worth $10,000 and repairs cost $7,500 or more, it’s likely a total loss.

Steps to Take

- Notify Your Insurer: Report the accident and provide documentation, including the police report, photos of the damage, and repair estimates.

- Understand the Valuation Process: The insurance company will assess your vehicle’s ACV, factoring in its make, model, year, mileage, and condition before the accident.

- Review the Settlement Offer: Insurers often start with a low offer. Compare it to independent valuations (e.g., Kelley Blue Book) and negotiate if it seems unfair.

- Provide Evidence: Submit documentation like maintenance records or recent upgrades (e.g., new tires) to justify a higher payout.

Options for Totaled Cars

- Accept the Settlement: The insurer pays the ACV, and you surrender the vehicle to them.

- Keep the Vehicle: You can retain the car with a salvage title, but it may require significant repairs and face restrictions on road use. Be aware that Georgia requires a salvage inspection before the car can be driven again.

- Negotiate a Buyback: If you want to keep the car, negotiate a lower settlement that allows you to retain ownership.

Diminished Value Claims

Even if your car is repaired, its resale value may decrease due to the accident history. In Georgia, you can file a diminished value claim against the at-fault driver’s insurance to recover this loss. An appraiser can help quantify the diminished value.

Gap Insurance

If you owe more on your car loan than the ACV, gap insurance can cover the difference. Check with your lender or insurer to confirm coverage, as this can prevent financial strain after a total loss.

Handling a totaled vehicle requires careful negotiation to ensure you receive fair compensation for your loss.

4. Navigating Insurance Claims and Avoiding Quick Settlements

Dealing with insurance companies is a critical part of the post-accident process. Insurers often aim to minimize payouts, so you must approach claims strategically to avoid settling for less than you deserve.

Why You Shouldn’t Settle Quickly

Insurance adjusters may contact you soon after the accident, offering a quick settlement to close the case. However, accepting too early can be a mistake because:

- The full extent of your injuries may not be clear for days or weeks. For example, soft tissue injuries often require ongoing treatment.

- Vehicle damage estimates may increase as mechanics uncover hidden issues.

- Once you sign a settlement agreement, you waive your right to seek additional compensation, even if new expenses arise.

Take your time to assess all damages before negotiating.

Steps to Build a Strong Claim

- Gather Evidence: Collect medical records, repair estimates, receipts for out-of-pocket expenses (e.g., towing or rental cars), and proof of lost wages. Include the police report and photos from the scene.

- Calculate All Damages: Account for:

Economic Damages: Medical bills, vehicle repairs, lost income, and other measurable costs.

Non-Economic Damages: Pain and suffering, emotional distress, and reduced quality of life. - Draft a Demand Letter: Write a formal letter to the insurer outlining your claim, including a detailed account of the accident, your damages, and the compensation you’re seeking. Attach supporting evidence.

Negotiating with Insurers

- Expect a Low Initial Offer: Insurers often start with a conservative amount to test your willingness to negotiate.

- Counter with Evidence: Respond with a higher demand backed by documentation, such as medical bills or expert appraisals.

- Avoid Recorded Statements: Be cautious about giving recorded statements, as adjusters may use your words to downplay your claim.

- Set a Deadline: Give the insurer a reasonable timeframe (e.g., 15 days) to respond to your counteroffer.

- Be Patient but Firm: Don’t accept an offer until it fully covers your losses.

Georgia’s Comparative Negligence Rule

Georgia follows a modified comparative negligence rule, meaning you can recover compensation only if you’re less than 50% at fault for the accident. Your payout is reduced by your percentage of fault. For example, if you’re 20% at fault and your damages total $10,000, you’d receive $8,000. The police report and other evidence are critical for establishing fault accurately.

Warning Signs of Unfair Treatment

Watch for red flags like:

- Delays in processing your claim.

- Offers that don’t account for all your damages.

- Denials of valid claims without clear justification.If you encounter these, consult a lawyer to protect your interests.

By approaching insurance negotiations methodically, you can secure a settlement that reflects the true value of your claim.

Schedule Your Free Consultation5. When to Consult a Car Accident Lawyer in Atlanta, GA

While some minor accidents can be handled independently, many cases benefit from professional legal help. A car accident lawyer in Atlanta can maximize your compensation and navigate complex legal issues.

When Legal Help Is Essential

Consider hiring a lawyer if:

- You’ve suffered serious injuries requiring extensive medical treatment or long-term care.

- Your vehicle is totaled, and the insurance offer is inadequate.

- There’s a dispute over fault, especially if the other driver denies responsibility.

- The accident involves multiple parties, commercial vehicles, or government entities.

- The insurer denies your claim or engages in bad-faith tactics.

Benefits of Hiring a Lawyer

- Accurate Claim Valuation: Attorneys know how to calculate both economic and non-economic damages, including future medical costs and pain and suffering.

- Skilled Negotiation: Lawyers counter lowball offers and handle communications with insurers, reducing your stress.

- Legal Deadlines: In Georgia, the statute of limitations for car accident lawsuits is two years from the date of the accident. A lawyer ensures all filings meet this deadline.

- Court Representation: If your case goes to trial, an attorney will advocate for you, presenting evidence and expert testimony.

Free Consultations

Most car accident lawyers, including Graham Scofield Injury Lawyers, offer free consultations to evaluate your case. This no-obligation meeting allows you to understand your options and decide whether legal representation is right for you.

Hiring a lawyer can make the difference between a minimal settlement and one that fully compensates you for your losses.

Contact Our Personal Injury Lawyers to Receive Assistance

Handling a car accident in Georgia requires a strategic approach to protect your health, finances, and legal rights. By taking immediate steps like documenting the scene and seeking medical care, understanding key documents like the police report, managing a totaled vehicle, negotiating with insurers, and knowing when to seek legal help, you can navigate the process with confidence. Avoid the temptation to settle quickly, as this often leads to undervalued claims. Instead, build a strong case with thorough evidence and professional guidance.

If you’ve been in a car accident, don’t face the challenges alone. Contact Graham Scofield Injury Lawyers at (404) 939-9470 for a free consultation. The team of skilled lawyers at our Atlanta personal injury law firm are available to help you secure the compensation you deserve and move forward with peace of mind.